Bretton Woods Resumen

En marzo el FMI publicó el resumen de algunos de sus trabajos más recientes sobre evaluación del impacto de género.

Bretton woods resumen. Donate to the Bretton Woods Project. Has specified five steps that must be taken today. Texto completo pdf 24 From the Bretton Woods Rupture to Financialization Teresa Aguirre.

The few historical studies that have addressed the formative years of the relationship between Argentina and the Bretton Woods Institutionsthe International Monetary Fund IMF and the International Bank for Reconstruction and Development better known as the World Bankbegin their narratives in the post-Peronist period. Documental de Desarrollo para estudiar. The Bretton Woods agreements and the Argentine position Resumen It is evident the oscillations in money value and the abandoning of the gold-bullion standard contributed to accentuate the chaotic situation in international trade considerably decreasing its volume annulling free trade and reducing it a system of barter and bilateral agreements.

En la actualidad ActionAid RU organización benéfica registrada 274467 hospeda amablemente al Proyecto Bretton Woods. In calling for a New Bretton Woods Lyndon H. When President Nixon finally took the dollar off its gold backing in 1971 the Bretton Woods system became defunct.

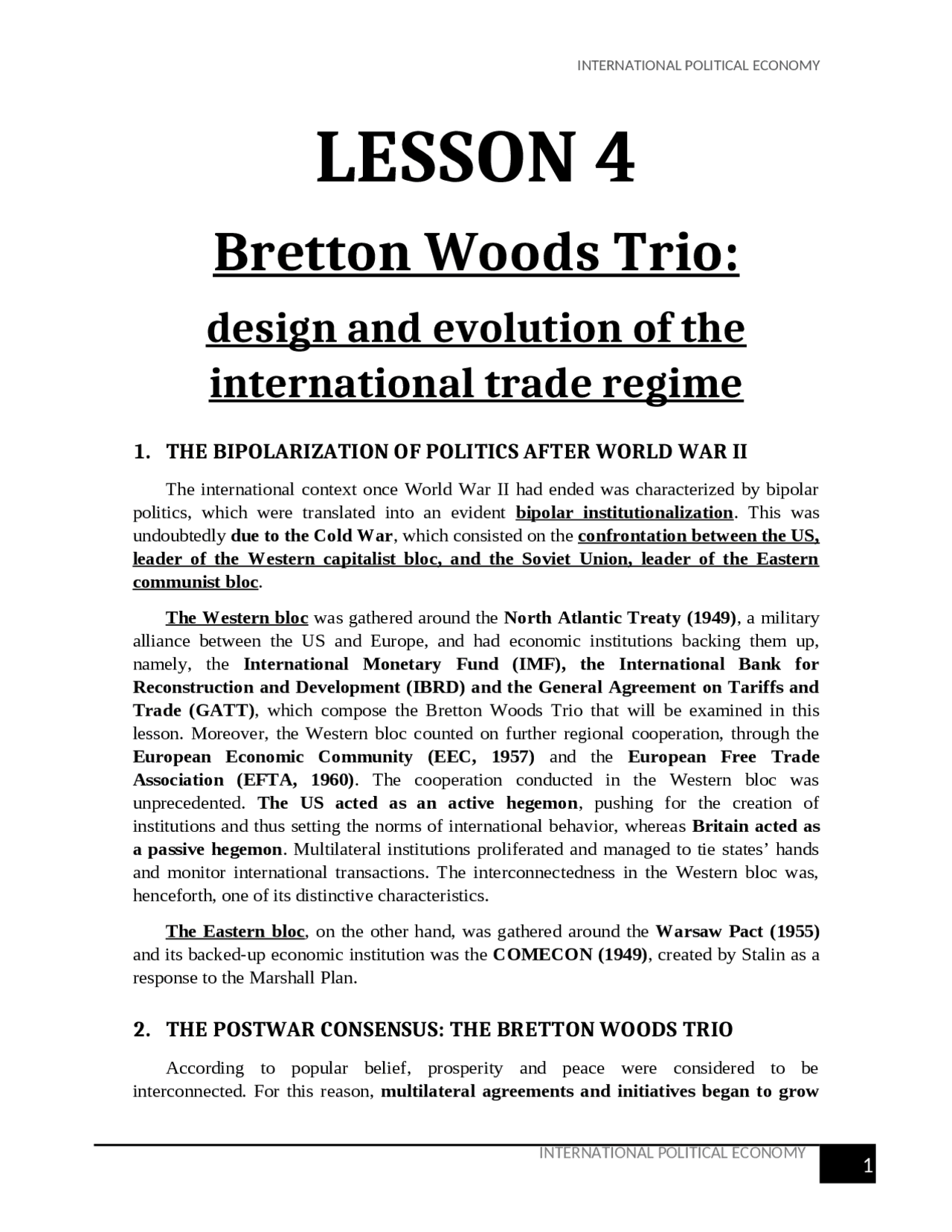

Replace the gold standard with US dollars as an international currency standard. America is a superpower that has an important role in the Bretton Woods agreement. Following the collapse of the Bretton Woods fixed exchange rate system in the early1970s2 These activities include regular monitoring and peer review by other members of economic and financial developments and policies in each of its members under ArticleIV of the Articles of Agreement ongoing reviews of world economic and financial market.

After signing the agreement America which is only one country that has the right to print dollars. The Nixon shock was a series of economic measures undertaken by United States President Richard Nixon in 1971 in response to increasing inflation the most significant of which were wage and price freezes surcharges on imports and the unilateral cancellation of the direct international convertibility of the United States dollar to gold. Global imbalances and the lessons of Bretton Woods Eichengreen Barry.

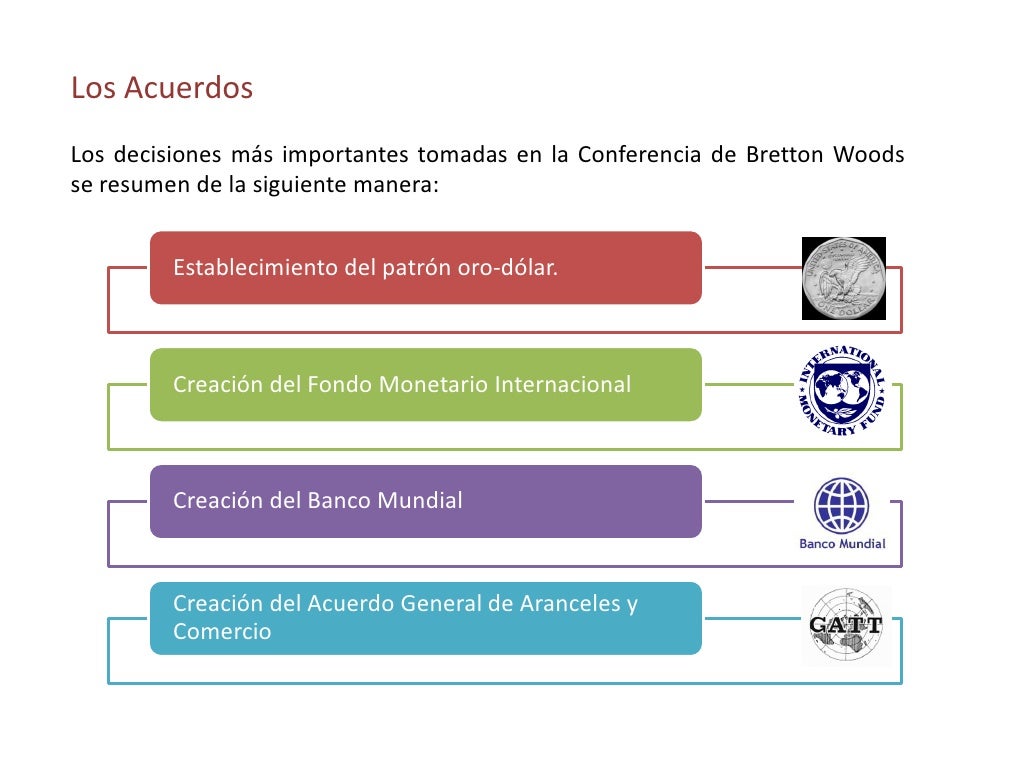

Antecedentes al Sistema de Bretton Woods Fin del patrón de cambios-oro Este sistema monetario surge de la Conferencia de Génova de 1922. The Bretton Woods system was a huge change in the worlds economic system. A Bretton Woods no fueron sólo los países capitalistas pero la supremacía de EE UU quedaría patente de principio a fin.